I’m certainly not the first pundit to comment on the recent economic meltdown, and I sure won’t be the last. But there is a side to this crisis that almost no one is talking about, perhaps because it hits a little too close to home—literally.

The two primary assumptions embedded in our national dialog seem to be that (1) like the dot-com bust of 2000, the problem is a fairly recent phenomenon caused by the latest round of irrational exuberance on Wall Street, and that (2) worst-case, we’ll all be able to go back to the old borrow-and-spend way of life in a couple years. Both are symptoms of denial that make it impossible to address the larger problem.

This crisis is not simply about bad suburban housing debt. By some estimates, more than one-eighth of the retail space in the U.S. will be sitting vacant within a few months. The graph at right illustrates that situation very clearly. I’m thinking you’ll be shocked by it. Whether or not that’s the case, kindly indulge me and read on.

This crisis is not simply about bad suburban housing debt. By some estimates, more than one-eighth of the retail space in the U.S. will be sitting vacant within a few months. The graph at right illustrates that situation very clearly. I’m thinking you’ll be shocked by it. Whether or not that’s the case, kindly indulge me and read on.

The proverbial elephant in the room is the amount of sprawling, redundant public and private infrastructure we’ve built since the end of World War II. This exodus to the suburbs quickly resulted in the hollowing-out of major parts of older cities and towns. Furthermore, the overwhelming majority of this development is automobile-based. Places to live, work, shop, and play are intentionally separated by vast distances. Low-density, separated-use zoning has ensured that there is far more infrastructure to maintain per-person than in older village, town, or city neighborhoods.

For this suburban system to function, residents are required to own, operate, and maintain a car. Or two. Or three. Nobody knows this better than the typical suburban family. While car ownership is expensive enough, it is not simply a matter of gasoline and monthly payments. The automobile incurs another immense cost: cars can’t operate without lots of flat, smooth, publicly-funded road infrastructure (read: roads, highways, and the accompanying electric, gas, water, and sewer utilities).

All of this is stupefyingly expensive. These indirect costs constitute the majority of the expense, yet remain invisible to most people—spread-out in the form of local, state, and federal taxes, or camouflaged as municipal bond debt or various other forms of government debt. So in addition to being redundant, this means that suburbia is a doubly expensive living arrangement.

The other point that I’m trying to make is that the migration of wealth to the suburbs has not been a free-market phenomenon. Customer choice is only a small part of the equation, or this wouldn’t have happened in virtually every American city at the exact same time in the exact same way. Which, of course, is exactly how it did happen.

I assert that much of the economic crisis we’re seeing today is simply the end result of decades of bad decisions driven by bad economic, transportation, housing, and land-use policy.

A mercifully short history of sprawl

To understand the sudden suburban migration of the post-WWII period, and what it means for us today, some historical perspective is required. Happily, I’ve done my best to keep it short.

Powerful enablers are required for such a sweeping thing to happen. Post-WWII suburbanization was caused not simply by the availability of the automobile, or postwar housing demand, but by a converging set of public policies that resulted in blighted cities, towns, and villages, as well as an uglified, overdeveloped countryside. Without getting into gory detail, the major enablers included the national highway system, subsidized government loans for new suburban housing, the often intentional withholding of needed capital to renew older neighborhoods, and notoriously destructive urban renewal projects. These policies, and others too, amounted to the most massive outlay of taxpayer subsidies and incentives the world has ever seen. The ’burbs were not built by chance. Or merely by customer choice.

This is not to say that these policies weren’t well intentioned. For the most part they were. But they were also largely naive and shortsighted. However, at the time, they were seen as necessary to address some of the largest concerns of the day. Foremost, this involved the very real possibility of lapsing back into a depression as American industry demobilized. These fears were inflated by the vast problem of re-employing the nine-million-or-so men and women formerly in uniform who suddenly found themselves out of a job.

Keep in mind also that after an almost 15-year period of depression and/or war, American cities were not in great shape. During that time, there had been little public or private investment, and cities still contained all of the noxious, unpleasant activities of the industrial age, accompanied by virtually none of the environmental protections we take for granted today. Also, during the war, hundreds of thousands of southern blacks had migrated to northern cities hungry for defense labor, adding a racial component to the issue. Finally, the steadily increasing population of cities had created a housing demand, especially among the middle class and the millions of young war veterans newly empowered by the GI Bill.

To avoid the obvious potential mess, the federal government decided to create a large set of subsidies and incentives for new construction and new land development. All at once, this would help alleviate housing demand and instantly create thousands of jobs in the construction trades.

At the same time, cities, perceived as overcrowded, dirty, and dangerous, became the victims of the so-called ‘urban renewal’ programs of the 1950s and 60s, a process by which many otherwise viable neighborhoods (most often minority) were demolished entirely and replaced with a smattering of low-quality publicly-subsidized housing projects. Families, businesses, and other community institutions were uprooted, neighborhood relationships were destroyed, and most residents were forced to relocate to other neighborhoods—many of which were, shall we say, less than welcoming. It is dfficult to overstate the amount of social stress and psychological trauma caused by this. Ever wonder about some of the reasons behind the urban race riots of the 1960s?

At the same time, cities, perceived as overcrowded, dirty, and dangerous, became the victims of the so-called ‘urban renewal’ programs of the 1950s and 60s, a process by which many otherwise viable neighborhoods (most often minority) were demolished entirely and replaced with a smattering of low-quality publicly-subsidized housing projects. Families, businesses, and other community institutions were uprooted, neighborhood relationships were destroyed, and most residents were forced to relocate to other neighborhoods—many of which were, shall we say, less than welcoming. It is dfficult to overstate the amount of social stress and psychological trauma caused by this. Ever wonder about some of the reasons behind the urban race riots of the 1960s?

Also under these programs, downtowns, waterfronts, and other older neighborhoods were mangled or obliterated by expressways and automobile-related transportation projects. It’s no surprise that urban renewal soon became sarcastically (and perhaps more accurately) known as ‘urban removal.’ All of this lowered the value of older cities, towns, and villages, and intensified the suburbanization subsidies already in place.

Primed and sustained by these subsidies, the suburban build-out has continued generally unimpeded in the decades since. It actually accelerated through the 1990s, driven by both cheap oil and a frenzied, anything-goes lending market. The map above remarkably demonstrates this. The red/yellow areas, amounting to at least half of the total colored area, represent the land developed from 1993–2001. The purple/blue is the land developed prior to 1993.

Think about that. At least as much land has been developed in this country in the last 15 years as in the previous 400 years of our history.

Not surprisingly, as people continue to move even further out, older suburbs have been experiencing the same problems of poverty, crime, and blight that city neighborhoods have seen. And so it goes.

The sprawl bubble

Today, the resulting problems are vast, intimidating, and painfully obvious. Yet it’s hard for most Americans to discern the problem, let alone see a way out of the woods. This is not only because we’ve got so much of our collective wealth tied-up in this system, but because suburban sprawl has become so culturally identified with the postwar “American Dream.” Indicting the system that produces sprawl is often seen an indictment of our very way of life.

And dissing the American Way is blasphemy, brother.

It’s therefore no wonder, though no less maddening, that we can’t seem to have an intelligent public discussion about this. It’s hard to broach the topic in public without really pissing someone off—often to the point of violent irrationality. Believe me, this is not a subject you want to bring up with strangers. Or in-laws. I know.

In any case, we’ve now got this glut of public infrastructure, most of which is obscenely expensive and redundant. Much of the older stuff has been in deferred maintenance for decades because we’ve been too busy trying to pay for all the new stuff. Accordingly, public debt is astronomical. In addition, the amount of private debt has never been higher, with average personal savings essentially zero. This is due in part because so many people have taken advantage of exisiting housing subsidies to buy homes they can’t afford and live lifestyles beyond their means. (Of course, there are other things that have contributed to this situation, but I won’t delve into all of them here.) The bottom line is that there’s no financial slack left in the system. State and federal governments, municipalities, banks, businesses, and individuals are all strung out on various forms of credit, because we’ve been collectively attempting to finance a way of life that is unaffordable and ultimately unsustainable.

This brings us back to the chart at the beginning of the article. If you didn’t see the significance the first time, you may want to look at it again. A simple measure of the current financial crisis is evident here: In 1960 the United States had about four square feet of retail per person. As of 2005, that number had risen to 38 square feet.

Yep, that’s right. This number includes not only the underutilized retail square-footage in older neighborhoods, but also the speculative, overvalued glut of strip malls and big-box stores of suburbia. The ‘dead mall’ has been a familiar sight across the country for a while now. Dead subdivisions are now common in suburban areas hardest hit by the housing crisis.

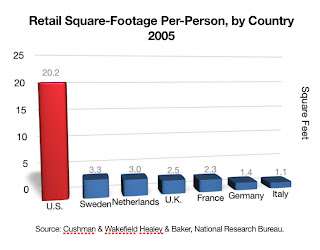

For a current comparison to other industrialized nations, see the second chart at right. While the U.S. number reported by this research is lower than the first chart (20.2 square feet vs. 38), it’s the relative difference between the U.S. and other nations that’s pertinent here. Note that other countries are still down where we were 50 years ago. You must then ask yourself these rhetorical questions: Do the Germans, French, or English live in some third-world consumer backwater? Are there overseas shortages of bread or iPods?

For a current comparison to other industrialized nations, see the second chart at right. While the U.S. number reported by this research is lower than the first chart (20.2 square feet vs. 38), it’s the relative difference between the U.S. and other nations that’s pertinent here. Note that other countries are still down where we were 50 years ago. You must then ask yourself these rhetorical questions: Do the Germans, French, or English live in some third-world consumer backwater? Are there overseas shortages of bread or iPods?

In any case, back to U.S. retail: As retail development follows residential, and both follow public infrastructure investment, one can infer that we’ve been sitting on a massive real-estate bubble for decades, propped-up by massive public subsidies. This is what I call the ‘sprawl bubble.’ In large part, this is the bubble that is currently bursting. This has implications for all Americans, not simply those of us living in far-flung suburbia.

Overdeveloped suburbs aren’t the only areas in bad shape. As we’ve seen, American cities, depopulated, disinvested, and impoverished, are not the mighty manufacturing centers they used to be. We’ve exported most of that activity to places like China, Mexico, Korea, and India. We’ve essentially become a country that doesn’t make things, simply existing as a market for other countries’ products. That’s why China holds a staggering—and ever increasing—amount of our debt. The Chinese must guarantee a market for all of their manufactured goods by propping up the value of our currency. Setting aside for a moment the irony that we’re now economically beholden to the world’s largest communist country, at least for now the relationship is a sort-of mutually-assured economic destruction.

Internally, much of our domestic economy is now tied to the construction and real estate finance industry which, using the capital provided by a runaway lending market, has been going gangbusters producing new suburban McMansions and strip malls—until quite recently, that is. It’s all come to a screeching halt, with the financial hucksters no longer able to hide the fact that much of this stuff has little or no value.

I’ve often wondered how long we’d be able to keep up this shell game. More and more, it’s obvious that this is a pattern of living guaranteed to bankrupt our country.

I may be wrong, but I’m thinking the piper finally needs to be paid. The scary thing is, for the most part, Americans won’t even admit the problem. I’m not an alarmist, but my fear is that we’re so pathologically attached to our system and its hallowed cultural myths that we’ll fight to the bitter end to sustain the unsustainable.

The next segment will take a more local viewpoint, exploring the phenomenon of sprawl here in the Buffalo-Niagara region.

This comment has been removed by a blog administrator.

ReplyDeleteFascinating article.

ReplyDeleteI grew up in the suburbs of Buffalo and now live in Los Angeles.

Here in LA I'm seeing retail shut down everywhere. Its scary to drive down urban shopping areas like Melrose, Robertson, Beverly, Colorado and even Rodeo to see every other storefront "for lease".

We're seeing a cultural shift towards saving propped up by a shrinking credit market which will lead to a serious decrease in spending and the need for as much retail as we've had here in the US for the past 8 years.

My concern is what to do with the open retail space occupying LA. These storefronts are usually one story and no bigger that 1500-3000 square feet. Because of their location they are certainly expensive aka overpriced and if there are no retail/restaurant/galleries to fill the spaces they will lay dormant for years to come.

My hope is that people will begin coming in from the suburbs to the city. With more density will come retail and soon enough these for Lease signs will fall.

An even greater concern is what if this actually happens? What if we witness a suburban diaspora? While tens of large and stalled housing complexes certainly exists to accommodate these "ex pats" the infrastructure does not. Where will we park our cars? Where will people attend school? How will people receive healthcare?

Ask yourself what problems would arise from an influx of population from the suburbs to the city and you will bear witness to the issues facing our country as a whole.

Public Transit, Education and Health Care all saw major cuts from the stimulus bill because of the need to bring 3 Republicans on board.

The US needs a comprehensive city by city, state by state solution to public transportation.

The US needs to fix our healthcare system so that we're not spending 3x the amount of other countries per person while receiving worse care.

The US needs a national strategy to revamp our middle, junior high and public schools.

If we can't solve the above issues we'll never dig ourselves out of this ditch and the web between our cities, suburbs and exurbs will be full of the carcasses of once occupied space.

You've got it exactly right. I have a paper you might like to see re: Buffalo in this context. E-mail me if you're interested: mcope@uvm.edu (formerly faculty at UB).

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteCan you say Benderson?

ReplyDeleteHow about we take some of Barry O's spending, er stimulus plan and DO something with it:

ReplyDeleteHundreds of acres of neglected cityscape lies in ruin...block upon block with mid 20th century homes shuttered...infested...one occupant per every 10 properties....

Take these few residents and respectfully relocate them.. Sure it will be tough...but make it worth their while....under those streets, you upgrade power and plumbing and create shovel ready plots...sprinkle in new berms, trees, put things on bus routes, build a library and fire hall...sprinkle in some small retail pockets....make the next Clarence suburban development (for example) happen within minutes of downtown...reduce reliance on 30 minute commutes, traffic, gasoline...

Life in the city is great. No more burbs. Charge more to rebuild infrastructure in suburban farmland....turn the lemon we suffer from (abandoned properties, suburban ring sprawling into ever distant suburban rings) into newness...all the advantages of a suburban pre-planned community with the convenience of downtown, the lake, the theatre.

Take those free gov't dollars to clear and make shovel ready tomorrow's neighborhoods a reality....big lots, varied hoe styles, 10 minute commutes, new life where now there is only decay.

Then get these communists, er, bureaucrats out of the way so entrepreneurs can build a business model to make it happen

I bet 30 percent of the city could EASILY be cleared and people would welcome access to Elmwood, Hertel, the medical campus, etc.

Long term, we rebuild the city from within...give people a reson to do it....

Sprawl - is a word heard thousands of times over the years in Lancaster New York.

ReplyDeleteInfra structure (sewers,water and roads) is ignored - build, build, build has been the local governments mantra.

They can do this because like all other large corporations lately have learned - in the end the taxpayers will be forced to pay. Whether its local, state or federal taxes - we will pay.

We will pay to upgrade and extend roads,bridges,waterlines,sewerlines and whatever it takes to keep the tax and spend system running.

Without this cycle, the "Political Machine in America" will shurely be exsposed for what it is - one giant tax fed, tax funded retirement system for those who live within the choosen ranks.

The workers - taxpayers are the cows that feed the system - as long as they are fed - they are happy - gladly unaware that if they don't produce the perscribed amount of milk(taxs) they then will be replaced and swallowed up by the same system they supported.

Why should we stop the sprawl - it creates jobs for some - temporarily - wealth for a small handful of the well connected and tax dollars to hide the over stuffed system we enjoy.

Who cares that some water lines are made of rotting wood, who cares bridges are failing, who cares that the newer subdivisions are pumping sewage into an already battered and overly burdened treatment system?

Our childrens generation and the ones that follow will surely thank us for their chance at the American dream - maybe they too will some day enjoy a tax funded bailout and live better than we have - isnt that what its all about, looking out for our futures ! ?

Joe, great article. Looking for side conversation to share some insights. Drop me an email at jasontheplanner@hotmail.com

ReplyDelete@ dgoshilla: you raise some good points. Both our cities and inner-ring suburbs are trashed. In a future of diminishing returns, we've certainly got our work cut out for us.

ReplyDeleteBut if our future does mean fewer resources and higher costs (particularly for energy), then the layout of the 'burbs is particularly badly suited. The subsidies and incentives that have artificially propped-up exurban development will, by and large, disappear. The least-valuable parts of suburbia may be good for nothing more than salvage. (In fact, over the last few decades, blight has overtaken many older, less-extravagant inner-ring suburbs surprisingly fast.)

In this future scenario, it'll be much easier to rebuild our older, traditional communities. Our land-use and development practices may begin to resemble something like common sense.

A comprehensive website that looks at open retail, parks, commercial and real estate development projects, foreclosure spaces and unsold property combined with information on current developments would be an incredible resource.

ReplyDeletePerhaps we should start an open source Google Map for Urban Planning.

I've put something together with a few examples to show you what I'm talking about. This could be a great resource for planners, business owners, investors and city officials. e-mail me at dgoshin@yahoo.com

http://maps.google.com/maps/user?uid=111098536190091663226&hl=en&gl=us&ptab=2

Joe, this was a very good article. Write more, please.

ReplyDeleteIf you like Joe the Planner (as I do), you'll love James Howard Kunstler: www.kunstler.com.

ReplyDeleteJoe: Your article is making the rounds.

ReplyDeleteAwhile before and co-incident with, the collapse of the retail economy, we are experiencing the Amazon.com phenomena!

In our household, 90 % of our expenditures are now online purchases. Most of our, get by automobile, stuff is perishables, hardware and business supplies. We maybe the extreme, living 23 miles from Safeway and 40 mile from Lowes and Office Depot, but online purchasing has become very user friendly and blogs have become the ideal way to check product workability and reliability.

We are in a “Paradigm Shift” of retailing and we may find that we are at “Peak” quantity of highway infrastructure other than upgrade.

Excellent! Thanks so much for this.

ReplyDelete